Higher-than-forecasted inflation in August has spurred anxieties about rising prices burdening families into 2023. But high prices and interest rates not only make it more difficult for families to afford essentials, obtain a loan, or keep working in the coming year, it also has long-term consequences.

Higher interest rates raise the federal government’s borrowing costs and future interest payments on the national debt. This puts young Americans in a double bind: they’ll be on the hook for these costs in the future, and the country is projected to invest less in them during their childhood.

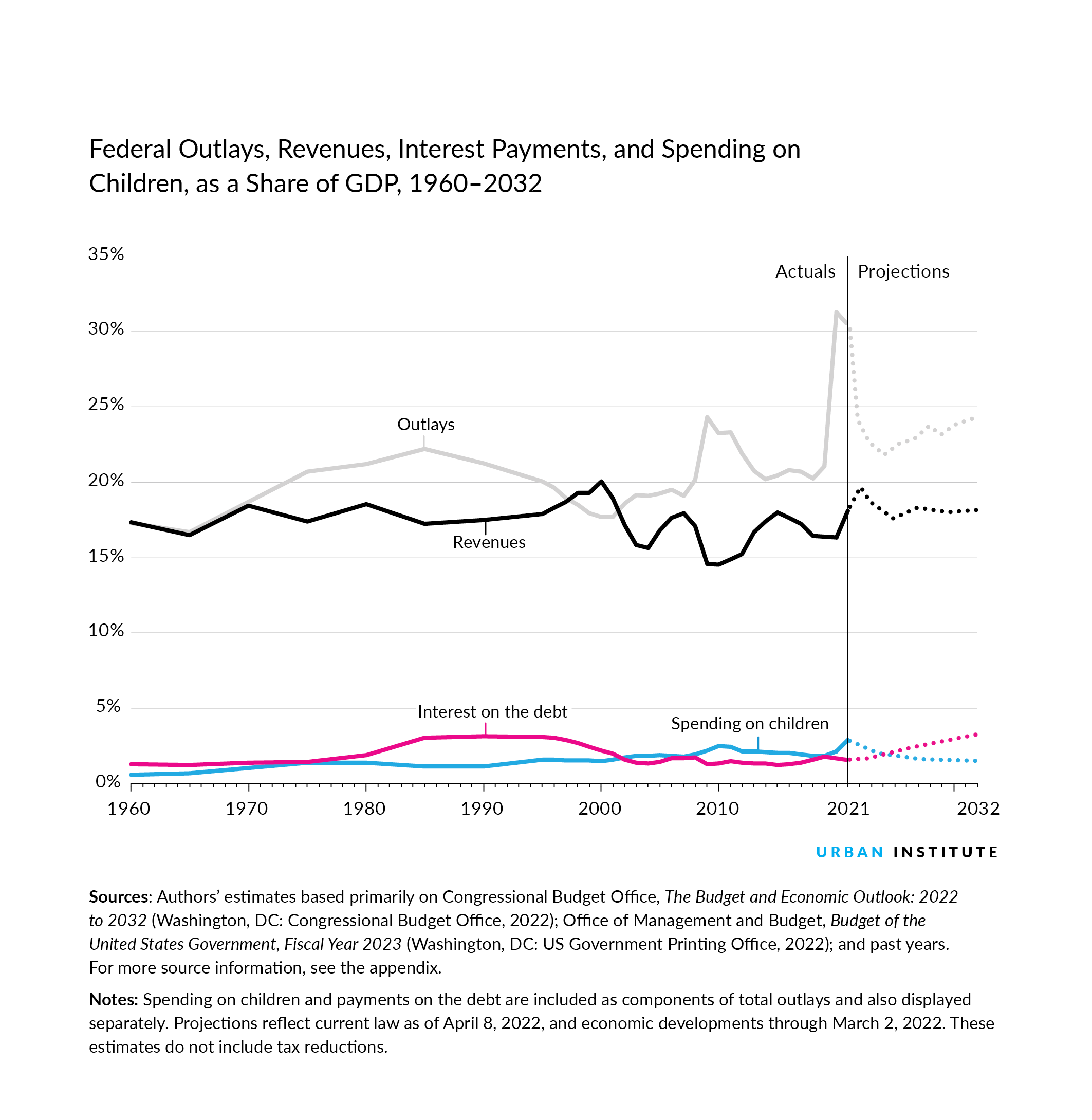

According to new research, spending on children, like overall federal spending, increased temporarily during the pandemic and contributed to a historic decline in child poverty. But federal outlays for children are expected to decrease this year as programs spend their emergency pandemic relief funding. Federal spending on interest payments and adult entitlement spending for Medicare, Medicaid, and Social Security are expected to further crowd out public spending on children over the next decade.

Public and private spending on kids has far-reaching consequences for the country’s workforce, economy, and educational, legal, and health systems. As policymakers weigh priorities and legislative options, considering both short- and long-term implications will be critical to promoting prosperity for both current and future generations.

Interest payments on the national debt are projected to surpass federal spending on children

Government spending on entitlements and other priorities has consistently outpaced the revenue generated from low effective tax rates. Combined with rising interest rates, this imbalance has led to an increasing national debt and higher borrowing costs for the government. As a result, payments on the debt are projected to grow as a share of the economy and to surpass falling federal spending on children by 2024. Tracking spending as a share of the economy, or gross domestic product (GDP), helps with understanding these public expenditures as priorities within the context of a broader, growing economy.

Interest payments are expected to more than double between 2021 and 2032, increasing from 1.6 percent to 3.3 percent of GDP, or from $350 billion to more than $900 billion in 2021 dollars. Conversely, federal outlays on children are projected to fall over the next decade by nearly half from 2.9 percent to 1.6 percent of GDP or from more than $640 billion to approximately $440 billion.

Where are we headed?

Public spending on children is an investment in the future; child care and early education, income support, nutrition, and health programs have positive long-term effects on children and benefit society at large. Less spending to support children may result in nominal short-run savings but will lead to a smaller economy and a less productive population in the long-run—despite the need for higher growth to keep up with the rising national debt and interest payments.

Evidence of how public supports benefit children, including the economic payoff of investing in different children’s programs, can inform policymakers as they consider the trade-offs of different funding priorities. The Inflation Reduction Act made substantial commitments to combat climate change, reformed the tax code to increase revenue, and invested in workers and health care for seniors but dropped proposals supporting paid leave, child care, and early education.

Children and young people have faced a pandemic that is unprecedented in their lifetime, labor market disruptions, and now, high inflation and the prospect of another recession. Emergency pandemic relief measures provided a temporary cushion but are now fading. Considering not only short-run or 10-year costs but also the long-term effects of decisions, such as proposals to extend the child tax credit expansion largely responsible for a historic decline in child poverty in 2021, can help ensure policy and legislation have universal benefits. Investing in children boosts the overall economy, helping all Americans and aiding, rather than further burdening, future generations.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.