Foundations are the backbone of the charitable sector, providing grants that support new programming, research, scholarships, and infrastructure. Though foundation spending accounts for just 0.3 percent of GDP, it can still make a big difference in stabilizing nonprofits during downturns—a crucial time when individual donations fall and demand for services goes up.

However, many foundations maintain a constant rate of payout of about 5 percent of their net assets, which means that the amount they distribute for charitable purposes rises and falls with the economy. Foundations might support the needs of the public better if they could increase grantmaking in bad times, rather than reducing grants when nonprofits need help the most.

Our new Tax Policy and Charities brief “Foundation Grantmaking over the Economic Cycle” analyzes National Center for Charitable Statistics data on foundation grants between 1997 and 2010, with particular focus on the Great Recession, when many foundations’ assets contracted with the economy.

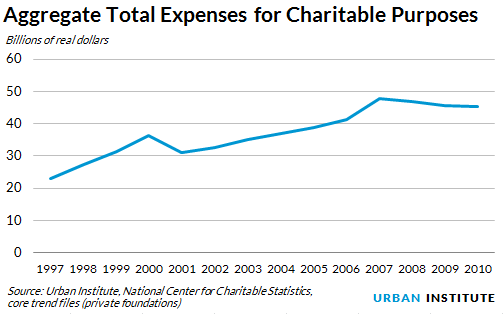

During the recession, net assets dropped dramatically from a total of $621 billion in 2007 to a low of $481 billion in 2009. Meanwhile, the total grants paid out by the foundation sector stagnated in real terms after a period of increases. Despite the 2001 recession and the Great Recession, the foundation sector has grown significantly in the past two decades. In 1997, payouts totaled $22.8 billion; by 2007, they doubled, peaking at $47.9 billion. After the Great Recession, total payouts started to falter, dropping to $45.3 billion in 2013. The decline would have been greater were it not for the formation and growth of some newer foundations during this period.

The impact on relationships between specific foundations and their grantees was larger than the impact on the economy. At the height of the Great Recession in 2009, over 40 percent of foundations paid out fewer grants than they had in the prior year.

Still, for many foundations, assets dropped by a larger percentage than grants. Payout rates, therefore, rose, with over 45 percent of foundations increasing their payout rate in 2009 relative to 2008. But by 2010, the pattern of rising payout rates quickly corrected its course and the median foundation’s payout returned to the typical 5 percent.

At a Tax Policy and Charities conference last year, participants discussed policies that deter some foundations from paying out more during bad times, including rules on excise taxes and on average payout requirements over time. The America Gives More Act, recently sent from the House to the Senate, would eliminate one perverse incentive: the dual-rate structure that often penalizes foundations for increasing their payout rate temporarily in any given year.

Independent of tax policies, many foundations and other endowed institutions clearly employ a simple formula that establishes a fairly constant payout rate each year. One reason may be that they become risk averse in bad times and fear increasing their payout rate when the value of their portfolio has already fallen. This still raises the issue of whether more countercyclical behavior might better maximize the public benefits of grantmaking from these important national endowments.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.