It’s tax day, and gauging by past years, nearly 20 percent of us have yet to file. But something very different is going on for low-income families. Many were among the first to file, even giving up 5 percent of their refund to get their money sooner. These families relied on Refund Anticipation Checks (RACs) and Refund Anticipation Loans (RALs), controversial financial products.

Proponents claim that these tax refund advances afford low-income people an inexpensive way to pay their tax- preparation fees and get their refunds quickly. Opponents say that the RAC/RAL industry takes advantage of unsophisticated tax filers, offering unneeded products and charging too much for the marginal benefit of receiving money a little earlier.

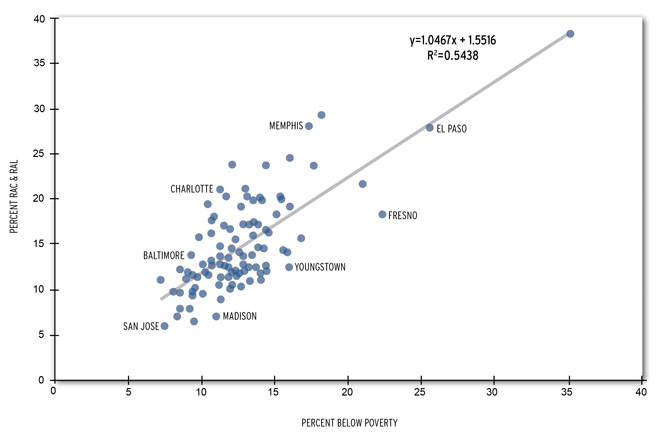

This is not a small business. Twenty million filers used RACs and RALs in tax year 2009. But national statistics mask some wide city-by-city variations in use. In metropolitan Memphis, more than one-in-four tax filers uses these products. In the San Jose area, just 6 percent do.

What explains this variation? Financial literacy, bank access, economic distress, racial discrimination, or something else? Unfortunately, local financial behavior has been understudied, so we don’t really know.

But new research on the take-up of RACs and RALs finds that living in a poor neighborhood is hugely consequential, even after controlling for a taxpayer’s own financial and demographic characteristics. A similar story emerges looking at larger areas: as the figure below shows, a metropolitan area’s poverty level correlates strongly with residents’ use of RACs and RALs.

Refund Anticipation Check/Loan Use & Poverty in the Top 100 Metropolitan Areas

Promising policy proposals and administrative improvements on the table include greater regulation of these products, allowing the splitting of tax refunds to pay tax preparation fees, and reducing the time it takes for a refund to be processed by the IRS. But to truly improve the lives of poor taxpayers, policies must address the forces driving the place-based concentration of RACs and RALs.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.