‘Tis the season for e-mail appeals and Santa-costume-clad bell-ringers outside every mall and grocery store. Inform your year-end giving with these fast facts from the Urban Institute’s Center on Nonprofits and Philanthropy.

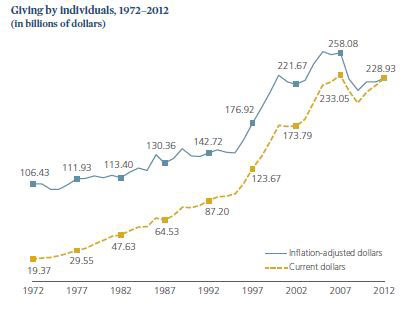

1. Individual giving is on the rise, though it’s still not at pre-recession levels. Individual giving peaked in 2005 and stayed relatively level until it took a dip in 2008. Donations dropped again in 2009, but every year since then has seen a gradual increase, reports Giving USA.

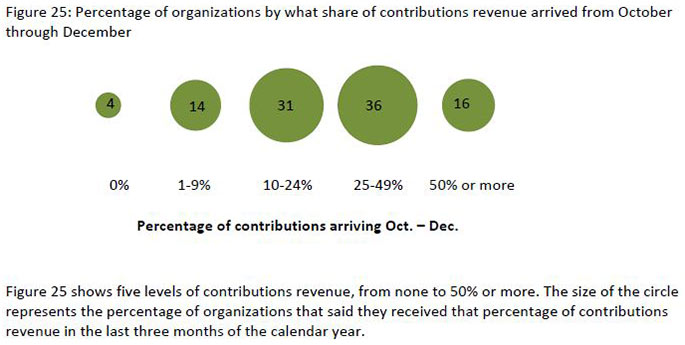

2. Yes, Virginia, there is a “giving season.” Over half of surveyed nonprofits told GuideStar that they receive most of their donations between October and December. Meanwhile, a 2007 study from The Center of Philanthropy at Indiana University found that respondents reported giving about 24 percent of their annual total between Thanksgiving and New Year’s Day.

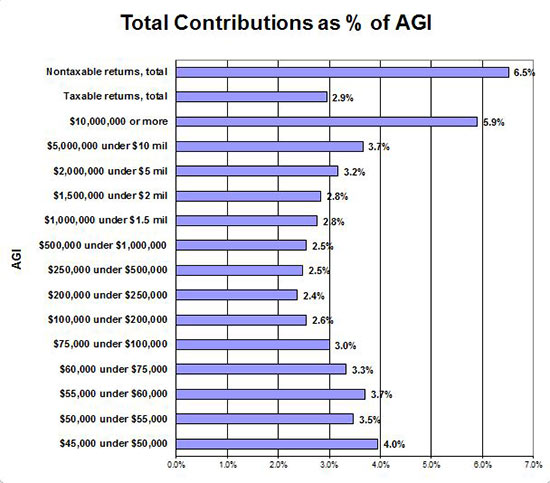

3. The more—or less—you make, the more you give. IRS data reveal an interesting trend: those at either the high end or low end of the income distribution tend to give a higher percentage of their income than those in the middle.

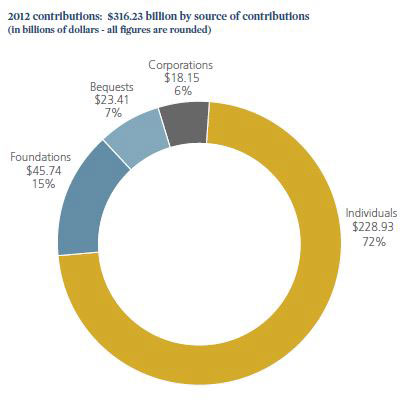

4. Individual donations make a big impact. In 2012, individual contributions accounted for 72 percent of all contributions. That year, individual gifts totaled $228.93 billion, an increase of 3.9 percent in current dollars (adjusted for inflation, a still-impressive 1.9 percent) from 2011.

5. Utah is the most generous state. Tax returns show Utahns’ yearly charitable deductions average out to $2,516. Other states in the top five include the District of Columbia, Maryland, Wyoming, and New York. (Stay tuned: the National Center for Charitable Statistics will publish a full report in early 2014.)

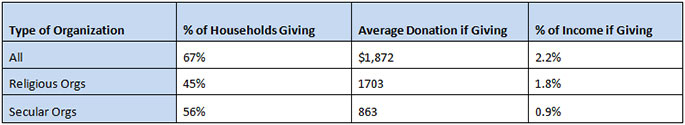

6. Those who donate to religious organizations give more overall. Though fewer households make charitable donations of $25 or more to religious organizations than to non-religious ones, those who contribute to religious organizations tend to give more overall, both in dollars per donation and in percent of income donated.

Photo by Jeff Chiu/AP

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.