The Department of Energy snookered the media last week with a report that seems to show that its clean energy lending programs are profitable. “Remember Solyndra? Those loans are making money,” went a typical headline.

Unfortunately, that’s not true. Taxpayers are losing money on DOE lending. Less than originally expected, and less than you would expect given media coverage of Solyndra, Fisker, and a few other failed loans. But smaller losses are still losses, not profits.

To understand DOE’s spin, consider a simple example. Suppose your spouse borrows $10,000 from a bank at 5 percent interest over 10 years so that you can lend it to your friend Bob on the same terms.

Everything goes well in the first year. Bob pays you, and your spouse pays the bank.

If your aunt asks how the deal is going, what would you say? A good answer would be, “We are breaking even; let’s hope Bob keeps paying us back.” You and your spouse are in this together, the loans from the bank and to Bob offset one another, and your best hope is for that to continue.

If DOE were asked, however, it apparently would say, “Things are great; Bob paid me $500 in interest, and I am on track to earn $5,000.” DOE takes credit for the interest that companies pay on their loans, but it doesn’t subtract—or even report—the interest costs that taxpayers pay to finance those loans. That’s like claiming profits on your loan to Bob, while ignoring the interest your spouse pays the bank.

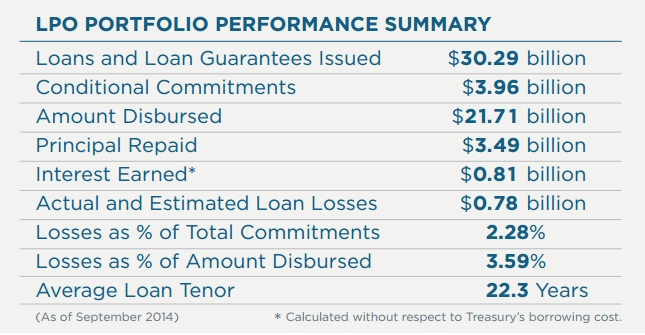

DOE’s report does not address this issue, except in a footnote in a table (cut and pasted to the right) revealing that its $810 million of “interest earned” was “calculated without respect to Treasury’s borrowing cost.” In other words, DOE reports gross interest received, not the net interest taxpayers have earned after subtracting Treasury borrowing costs. The incomplete figures in the table seem to suggest that DOE has eked out a $30 million profit on its lending ($810 million in interest less $780 million in loan losses). But when we account for Treasury borrowing costs, taxpayers are actually well behind.

The report does not allow us to say just how far behind. We do know, however, that DOE loans are typically made at small, sometimes zero, spreads above Treasury rates. So a large portion of DOE’s “interest earned” must have been offset by borrowing costs. That puts taxpayer losses in the hundreds of millions of dollars.

The same concern applies to DOE’s statement that interest payments on these loans will eventually top $5 billion. Some media outlets are reporting that as $5 billion of profit. It’s not. That $5 billion does not include the cost of Treasury financing or of any defaults. DOE’s $5 billion figure is like claiming your loan to Bob is scheduled to bring in $5,000 in interest; it’s technically true, but tells you nothing about profits. Indeed, the Obama administration still predicts that DOE’s loans will lose money over their lifetimes.

DOE’s lending programs should not be evaluated solely or even primarily based on their profitability or lack thereof. What matters is their overall social impact. How much are they advancing new technologies? How much are they reducing future pollution? Have they created jobs and economic growth? And are any gains worth the taxpayer subsidies? Those are the questions we should be trying to answer.

If DOE wants to play the profitability card, however, it should do so in an accurate and transparent way. Last week’s report falls woefully short. DOE owes taxpayers an honest accounting of the financial performance of its lending programs.

P.S. In recent work, I raised concerns about how the government budgets for lending programs. One issue is whether we should measure profitability against Treasury borrowing rates (as currently done) or against market rates (which the government could earn by unsubsidized lending). I expected that issue to arise in DOE’s accounting. Instead, the agency ignored the cost of capital entirely. Budget policymakers eliminated that ploy more than two decades ago, so it is stunning DOE would resurrect it.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.