Last month in MetroTrends, Margaret Simms pointed out that Social Security is more than a retirement program since it also provides income support to disabled workers and the dependent spouses and children of retired, disabled, or deceased workers. Let me second her point that Social Security is vital for many households whose benefits comprise much or, in some cases, all their income. And let me show you what this means in my hometown—Washington DC.

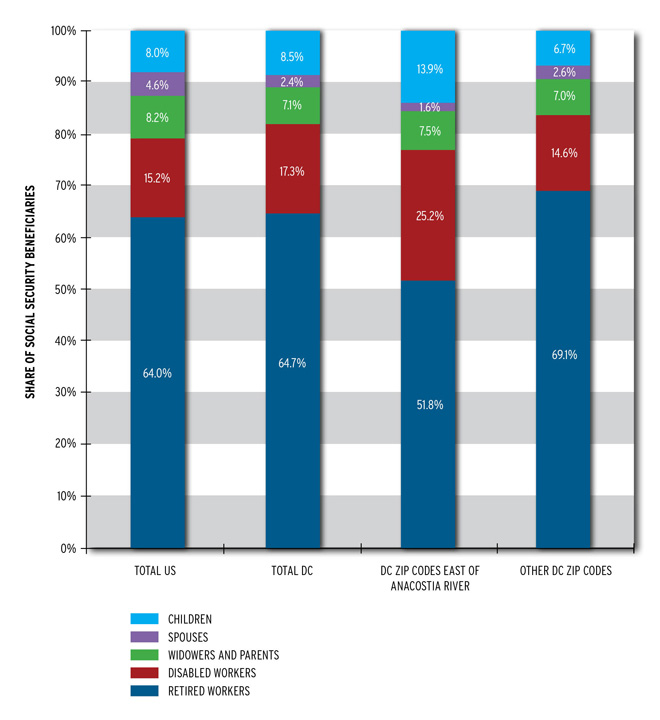

Social Security Administration data on DC show quite clearly that the program’s impact varies by neighborhood. While the distribution of Social Security beneficiaries by benefit type as a whole mirrors national numbers, various program components have more impact in some city neighborhoods than others. For example, in DC zip codes east of the Anacostia River, disabled workers’ and children’s benefits are more prevalent than in the U.S. as a whole, while in the remaining zip codes retired worker benefits are more common than average. Data on total benefit amounts—rather than beneficiaries—show a similar picture.

Distribution of Social Security Beneficiaries By Type of Benefit Nationwide and in the District of Columbia, December 2010

Source: Social Security Administration, OASDI Beneficiaries by State and ZIP Code, 2010

These patterns reflect deep structural differences in Washingtonians’ experiences and opportunities. Reflecting the city’s history of racial segregation, DC neighborhoods still differ greatly in their demographics, income, and wealth. East-of-the-River communities have younger populations, relatively more African Americans and fewer foreign-born residents, more adults without a high school diploma, lower average incomes, and higher unemployment and poverty rates than DC averages.(To compare local characteristics, try this handy tool that presents demographic and economic data about DC by zip code on the NeighborhoodInfoDC website, a partnership of the Urban Institute and the Washington DC Local Initiatives Support Corporation.)

Given DC’s heavy reliance on Social Security, those of us who live here have a major stake in proposals to change the program. Confirming findings from the Urban Institute retirement policy program’s broader work on Social Security, one priority should be accounting for differentials in key life-course processes, like disability, employment, mortality, and marriage. In particular, some proposals exempt disabled workers from certain benefit reductions and others don’t. Congress needs to consider diverse, changing family and work lives when considering program adjustments.

A second concern is related: design details can affect economic well-being more in some communities than others. Our recent study on the distributional effects of the Social Security proposal of the National Commission on Fiscal Responsibility and Reform describes one provision to cover newly hired state and local workers that would have disparate impacts in a handful of states including Massachusetts and Ohio, where comparatively fewer public-sector workers participate in Social Security. Likewise, the proposal’s differential effects by lifetime earnings and birth year would mean larger average benefit reductions in some communities than others if Congress were to enact legislation like this.

Comparisons presented in our report drive home a third key point: the sooner Congress puts Social Security on a sounder financial trajectory, the smaller the program changes will need to be. Earlier action gives workers and beneficiaries more time to plan and, if necessary, work and save more to reach their retirement income targets. Haste in changing this essential program would be pound foolish, but sooner is better than later for bringing the system into long-run fiscal balance as Baby Boomers’ retirements narrow policy options.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.