When we think about federal support for children, programs like Head Start or the Children’s Health Insurance Program might come to mind, but tax provisions provide substantial support for children.

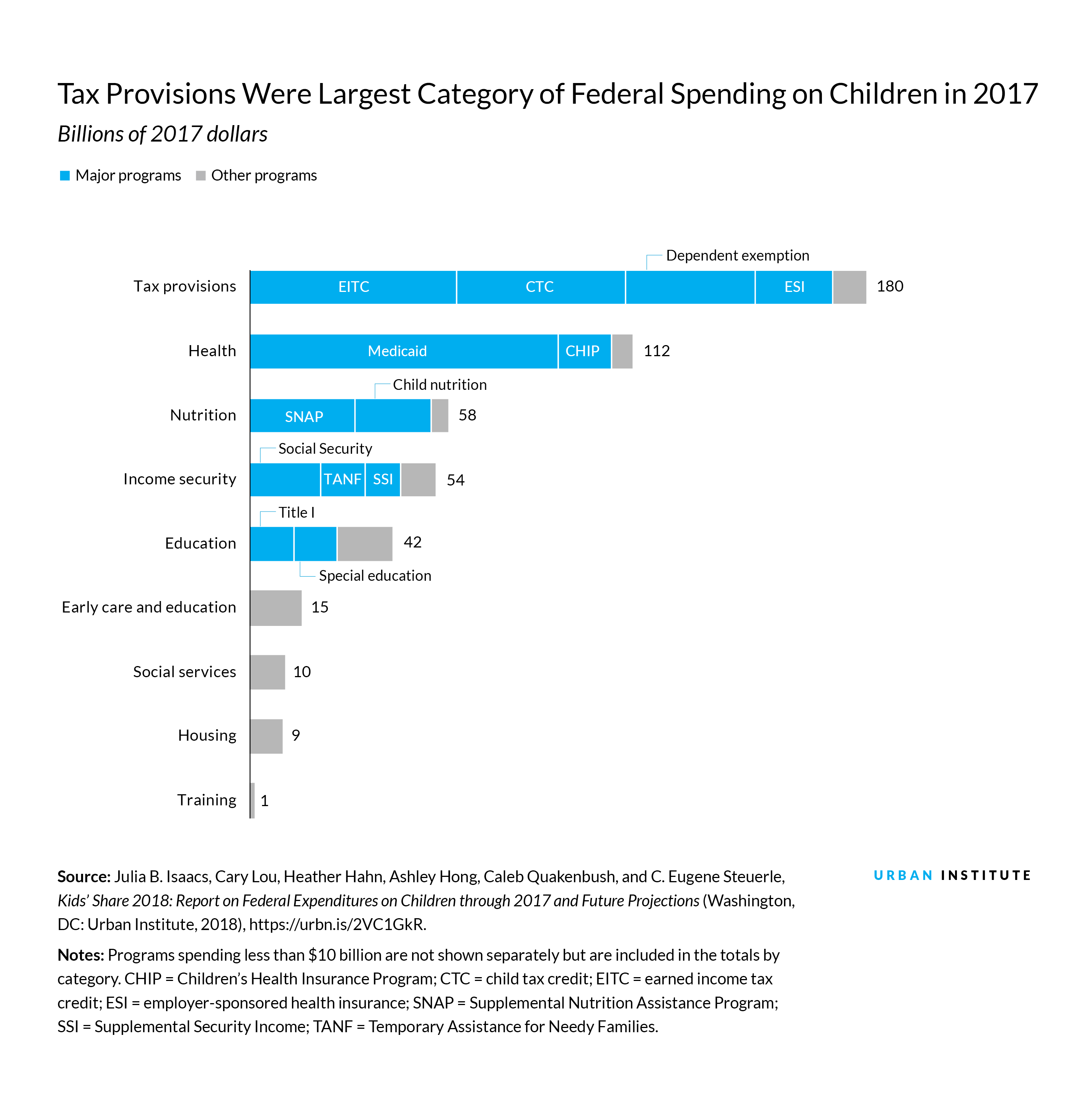

When counted together, tax provisions that benefit children far exceed any other major budget category of spending, according to the Urban Institute’s annual Kids’ Share report. Expenditures on tax provisions totaled $180 billion, or 37 percent of total 2017 federal expenditures on children.

This total included $74 billion in the form of tax refunds (cash outlays) to families and $106 billion in tax breaks (reductions in tax liabilities to those otherwise owing individual income tax). Ninety-five percent of families with children (all but the very rich and the very poor) receive some tax benefit.

In 2017, the largest child-related tax provisions were the earned income tax credit ($60 billion), the child tax credit ($49 billion), the dependent exemption ($38 billion), and the exclusion from income taxation of employer-sponsored health insurance for dependent children ($23 billion). Each of these tax provisions provided more support for children than any other single program, except Medicaid.

Taxes paid this Tax Day will differ somewhat because of the Tax Cut and Jobs Act of 2018. The dependent exemption has been phased out and replaced by an expanded child tax credit. As a result, child-related tax provisions in 2019 are expected to be even higher than those shown above. But over time, the Tax Policy Center projects that child-related tax expenditures will decline because the child tax credit is not indexed to inflation.

Taxpayers with children may have noticed the higher child tax credit as they filled out their tax forms. But all taxpayers should keep in mind that tax season is not just about paying into the government. It’s also about providing for children and ensuring their healthy and safe development into adulthood.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.