State and local governments provide many of the public services that directly affect people’s day-to-day lives. They run elementary and secondary schools, colleges and universities, administer health and social programs like Medicaid, and manage our nation’s highway system.

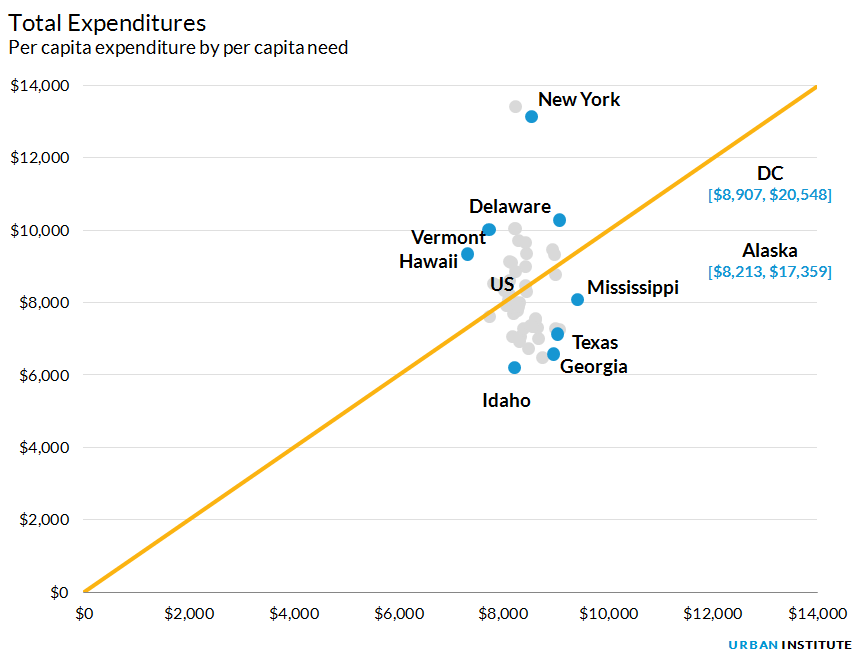

When analyzing policy, we often compare states by what they spend on public services. In 2012, the average state spent $8,443 per person on direct state and local general expenditures, and spending ranged from $6,213 per capita in Idaho to $17,359 in Alaska. But what drives this variation? And what would each state have to spend to meet a specific level of its residents' needs?

In a new report my coauthors and I measured how a state’s actual spending compares with what it would spend (expenditure need) if it followed national averages in terms of the level of services provided—given its demographics, economies, and geography.

To measure need for each expenditure category, we determine the demographic or economic features of a state that contribute to spending cost (workload factors). For example, a state’s school-aged population affects its K-12 expenditure needs. After adjusting for labor costs and input prices in each state, we calculated what spending would be if each state spent exactly the same amount per workload factor, such as per kid or mile of highway in a state. States with high total spending need were generally lower income and had more kids—with more kids and elderly living in poverty—compared with the national average.

In many states, actual expenditures were roughly in line with need. However, in some, spending greatly diverged from need. For example, even though we calculated the same per capita need in both Massachusetts and Kansas (about $8,250 per capita), Massachusetts’s actual per capita expenditures ($10,024) were about $2,050 more than Kansas’s per state resident ($7,970).

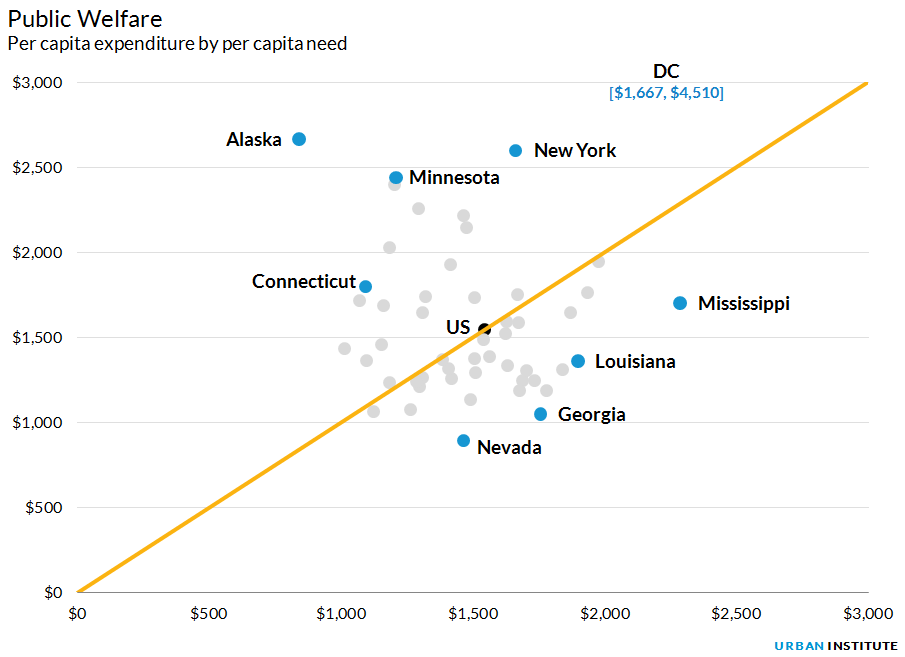

There were notable differences on specific spending categories, too. Take public welfare, a spending category that includes cash assistance to individuals, payments for health insurance, Medicaid, and to private medical providers, and administration costs for these programs. We based public welfare need on the proportion of a state’s total population and the proportion of its elderly population that was low income (with more weight on the former). We found many states with low need and high actual expenditures (Alaska, DC, Minnesota, and Vermont all spend twice as much as their calculated expenditure need) and vice versa (Alabama, Arizona, Florida, Georgia, Louisiana, Mississippi, Nevada, South Carolina, and Texas all spent 25 percent less than their calculated need). This may be a good example of policy decisions at the root of actual spending divergence. Most of the states with low actual expenditures (but high expenditure need) have less generous Medicaid eligibility rules, indicating a chosen policy to provide services to fewer of their citizens.

That said, our calculation of a state’s expenditure need is not indicative of an optimal level. Rather, it’s a benchmark, based on national averages, against which policymakers, journalists, and voters can assess problems and opportunities facing state and local finance.

Furthermore, given balanced budget rules in place in all states but Vermont, states must balance spending and revenue and it can be politically difficult to raise revenues despite additional expenditure needs. In the report we also calculated what states could collect from taxes and fees if they used national average state tax rates, given demographic and economic conditions in the state (revenue capacity). For more on that see the post on TaxVox by my coauthor Richard Auxier.

Ultimately, we found that states with the highest expenditure need often have the lowest revenue capacity. We label the difference between expenditure need and revenue capacity as the state fiscal gap at capacity. In 2012, 26 states had fiscal gaps at capacity even after we added federal grants to the state’s revenue capacity. States with particularly large fiscal gaps included Alabama, Arizona, Arkansas, Georgia, Idaho, Kentucky, Mississippi, Nevada, and South Carolina.

The federal government should take these disparities into account when making policy decisions such as allocating federal grants. By understanding gaps in need and funding, the federal grant programs could more efficiently direct money to where it is needed the most. Also, state and local governments should look closely at how their spending lines up with their residents’ needs. And finally, citizens should look under the hood of their governments to see how their state is allocating its resources and meeting its needs.

For details on sources and methodology please see the full report.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.